Las Vegas Jewelry Week Download: 2025 Market Pulse

"Customers were there to buy" as designers are "DIALED IN" to new directions.

This year, for the first time in years, I missed the Las Vegas jewelry shows, and I genuinely felt like I was missing out. This was especially true as I scrolled through Instagram (mostly stories) and saw several Substack superstars—namely

and —at Couture. Ladies, we need to connect irl! But there's always next year…The insights and trends from these pivotal industry events are simply too important to skip. So, in lieu of my usual trip recap, I've put together a special report. I caught up with several friends—dealers, buyers, and industry experts—all of whom were on the ground at JCK, Couture, AGTA GemFair, and the Las Vegas Antique Jewelry & Watch Show. Their collective perspectives offer a comprehensive look at the current mood, key trends, and prevailing business realities in the jewelry world. Let’s unpack!

There's a lot of great content here! To ensure you see everything, open this email in your browser or, even better, view it in the Substack app, which I highly recommend.

Interviews have been edited for clarity and length.

The Colored Gemstone Market: A View from the AGTA GemFair with Megan McGaffigan of Kimberly Collins

What was your general impression of the AGTA GemFair this year? How was the attendance, and what was the overall mood among colored gemstone dealers and buyers?

Megan McGaffigan: I was surprised; it was busier than last year, for sure. You could really feel the energy in the room. Customer sentiments were positive. I mean, I didn't know what to expect with things like the price of gold, the political landscape, and tariffs – all these kind of doom-and-gloom, looming things that feel heavy. I was optimistic, but also a little like, "we'll see how this goes."

But customers were buying! It seemed like the customers who showed up were there to buy. There was not a lot of tire kicking. Transactions were closing, people were paying, things were moving. I was very surprised, but happy, to see that the industry seems to be doing well. Customers were even saying that they were having great sales in their own stores. April historically was a bit slow, being tax month, but other than that, people were reporting May and June were looking good.

What were the standout trends in colored gemstones? Were certain colors, cuts, or types of stones particularly popular?

Yeah, long shapes were big — long step cuts, long cushions, all day long. Generally, stones over 1.5 to 2 carats, more "statementy" type things. Tourmaline has been really hot, especially chrome tourmaline, if you have it. This show also saw a lot of peridot. It could be because we're heading into August (birthstone), but also Kimberly stocks really beautiful peridot.

Anything with just really juicy color and well-cut was popular. But particularly the long, elongated shapes. Hexagons are out of the fancy shapes; those would probably be Kimberly's most popular kind of off-beat fancy shape — the long ones or the symmetrical ones.

Was there strong demand, or more cautious purchasing?

I was surprised there was less caution than I expected. I think buyers understand that Vegas is not a cheap place to attend, let alone exhibit. So, I think it really kind of weeds out the people who are serious about investing in and procuring new inventory, and who truly have buying power. It filters out, maybe, those newer to the industry or up-and-coming with less cash flow. So, I think part of it is that Vegas naturally sifts out different types of buyers based on their cash allocation for new stock.

Have tariffs or broader geopolitical factors influenced the colored gemstone trade in any significant way? If so, how has that manifested (e.g., pricing, availability, sourcing)? What was the sentiment around this at the show?

There was conversation about it, like, "What's happening?" Nobody really knows. AGTA is working, trying to work in Washington to get some of these things figured out, but there hasn't been progress. Tariffs will be instated on July 9th – the AGTA article has the definitive date for that. I do think that because many of these goods are already in the U.S. and at the show, it was also kind of incentivizing people – a little bit of a "tariff panic" – to acquire goods that have been exempt.

How do these market dynamics and any tariff impacts ultimately affect the end consumer's access to or pricing of colored gemstones?

I think it will come down to how people are selling the perception of this hurdle, not just the actual hurdle and how it trickles down to the end consumer. There's going to be new dialogue and new conversation. I don't know where that tipping point is, where it becomes the norm. It'll be very interesting to see what happens. But for now, people who already have their goods in the United States will definitely be at a price advantage.

To clarify, are you saying that prices need to reflect this new tariff, and that will be part of the conversation with customers?

Yes. So, let's say as a wholesaler, we bought something for $50 and imported it, and there's a 46% tariff on it. Now the new cost is nearly $100. Then we apply our markup, and as it trickles down, how do you talk about that? If it's a nearly doubled cost at the back end, where is it absorbed? Where are you conversing with the customer? How are we, as wholesalers, talking to our retailer customers about it? And then, how are we empowering our retail customer to talk to the end consumer about it?

I'm really intrigued to see how those dialogues develop and what strategies people take for that. And then, do people who already have their goods in the U.S. mark their prices up to match the new ones and increase their profit margins? Or do they go low and really take advantage of moving it, but then they can't afford to replace the goods at the same price? I just don't know how that's going to maneuver.

Sasha Krivitsky, Oakgem: Insights from the Las Vegas Antique & Watch Show

How did traffic at the Antique and Watch Show compare to previous years, and would you describe it as a successful show?

Sasha Krivitsky: It was significantly more positive, even compared to last year. Most dealers I spoke with were very happy. The show was consistently active, with a strong presence of both retailers and private jewelers.

Did this level of success surprise you, given the current global economic climate?

Yes, I think that's why everyone left on such a positive note. Our expectations, given the current state of the world, were tempered. So, the show's success was a pleasant surprise.

You mentioned an uptick in private jewelers at the antique show, which seems to echo what others have observed in this segment. What do you attribute this to?

I agree there's been an increase. I believe private jewelers are increasingly looking to estate jewelry due to its relative affordability compared to new pieces. With the rising prices of gold, labor, and impending manufacturing tariffs, estate jewelry offers a more financially viable option, in addition to aligning with current market trends.

The escalating price of gold is a major industry topic. How did this influence buyer preferences at the show? Did you notice a shift towards specific types of pieces or more non-gold items?

We did see more emphasis on silver, particularly cool, funky pieces like Jensen silver, and larger statement items. For us, however, bold, signed gold pieces continued to perform very well. Observing the Couture show, I noticed a wider variety of materials being used beyond gold – things like leather cords and large, colorful beaded necklaces, in contrast to the prevalence of gold chains seen previously. This suggests people are getting creative due to today's gold prices.

How do these gold prices impact your inventory decisions, especially regarding "melt versus hold" strategies? Are you having more discussions or taking action to melt down substantial pieces that have been slow to sell, or are you holding out for potentially higher prices despite the current high cost for consumers?

It definitely influences our decisions. We've been consistently melting pieces as gold prices have risen over the past six to eight months. We try to avoid melting larger or signed pieces, but we regularly audit our inventory. If an unsigned gold bracelet with diamonds, for example, isn't moving, and its value surpasses its gold content, melting it allows us to recoup funds and replenish inventory. This is something we do on a weekly basis.

Beyond what we've discussed about consumer spending trends and the success of bold, signed pieces, what other hot ticket items or periods are you observing?

This year, we saw a notable increase in international buyers. Many of them were particularly interested in Buccellati. While we've always stocked Buccellati, we typically haven't wholesaled it much. However, we brought a few pieces to this wholesale-only show, and nearly all of them sold, mostly to international buyers. That was very interesting to observe.

Why do you think Buccellati is experiencing this “resurgence”?

Buccellati's acquisition by Richemont and their current focus on building a heritage collection are certainly elevating the brand, making it an even more recognized name in jewelry. I'm sure this is impacting the secondary market. The international appeal, however, was particularly intriguing.

So, Buccellati is one to watch. Have you noticed any shifts in how folks are sourcing their inventory, or are certain types of pieces becoming harder or easier to acquire in the current market?

In terms of harder to acquire, primarily due to price and availability, anything iconic from 1980s Bulgari is challenging. There's high demand, and people are actively buying these pieces at very high prices. Collections like Monete, anything with chunky cabochons, curb chain styles, and Tubogas watches are currently at a premium and difficult to find.

And on the flip side, what pieces have you seen cooling down?

For us specifically, certain niche brands we like to buy, such as Elizabeth Locke and Elizabeth Gage, have seen a slowdown. Our clients are usually very receptive to these brands, and we've always done well with Elizabeth Locke category earrings in particular. For some reason, these have cooled down, though we continue to buy them actively. We find them fun, vibrant, wearable, and a great value on the secondary market.

Mirta de Gisbert, Jewelry Advisor & Curator: Couture Jewelry Trends

Mirta de Gisbert, a jewelry expert, gemologist, advisor, and curator, specializes in fine and vintage watches, as well as design and sourcing. As a Couture and Antique Show veteran, her insights are invaluable. She breaks down the trends observed at this year's shows:

1. TOURMALINE

Mirta de Gisbert: “I find the stone beautiful, but also because I started to notice a shift in the industry where people are becoming agnostic to the old-school traditional gem classifications of precious vs. semi-precious.”

Tourmaline, whose varieties include the vibrant pink-to-red Rubellite, is a gemstone that comes in an astonishing array of colors and hues. Traditionally classified as a "semi-precious" stone, it has historically been seen as a less exclusive choice compared to the "precious" four (diamonds, rubies, sapphires, emeralds). However, as Mirta points out, the modern market increasingly values unique beauty, rarity, and color intensity regardless of these older categorizations, leading to a surge in demand and appreciation for exceptional tourmalines like Paraiba and chrome tourmaline. This shift reflects a broader consumer interest in beauty and individuality over traditional status.

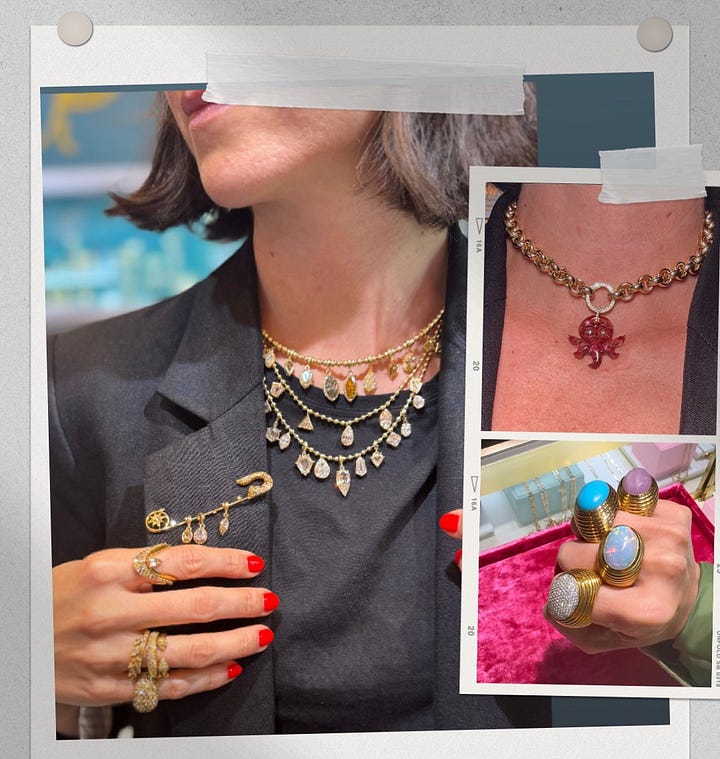

2. RIPPLE RINGS

“Gold prices may be on the rise, but that’s not stopping jewelry designers from creating beautiful gold rings, and the ripple design is one of my absolute favorites.”

Instead of relying solely on gemstones for sparkle, ripple rings emphasize the metal itself, often featuring undulating, organic, or textured surfaces that mimic the gentle flow of water. These sculptural gold designs allow the inherent beauty and warmth of the metal to take center stage, creating pieces with significant visual impact through form rather than just carat weight. Mirta specifically points to the stunning designs by NeverNoT, Jade Ruzzo, and Helena Rose as leading examples of this trend, showcasing how designers are masterfully creating pieces that are both luxurious and visually dynamic while maximizing the artistry of gold.

3. 70s JEWELRY

“Earlier this year, when I attended the OMBAS, I noted the 70s were making a comeback in vintage jewelry. Now, after attending Couture, I am here to tell you, contemporary fine jewelry designers are DIALED IN and the 70s ARE HERE.”

Periodt. cc: Harwell Godfrey

4. FRINGE NECKLACES

“They are timeless, elegant and effortlessly sexy…”

Mirta sighted noteworthy fringe at Khepri, Renna, and Jenna Blake.

5. 6. and 7. More noteworthy trends include textured gold and statement bracelets. And then there's Jasper, another stone, as Mirta noted, that shows the shift where designers and wearers alike are less bound by the conventional classifications of precious versus semi-precious.

And that, my friends, is a dispatch! That wraps things up for now, but there is much more on the horizon. Stay tuned for:

A deep dive into the current state of diamonds.

A look at why some jewelry values skyrocket while others stagnate or fizzle.

Contemporary designers to watch.

Plus, more stories from the Collector’s Eye series.

Thank you so much for reading. If you enjoyed this post, a quick like always helps new readers discover this growing newsletter. I am incredibly grateful for your support!

xx Veronica

If you are new here, please catch up on my previous posts—archived posts can be unlocked with a paid subscription (and if I do say so myself, there are loads of good reads there). If you'd like to show your support in another way or aren't ready to subscribe, you can always buy me a coffee!

Also, please keep the chat going! And for sourcing requests, DM me or email vvalentinenyc@gmail.com.

CHOCK full of intel!!! Next time we HAVE to meet up please!!!

I LOVED THIS — felt like I was back!!!!!!!